Bank Reconciliation:

A Student-Friendly Guide

Introduction: Why Bank Reconciliation Matters

Welcome to the world of bank reconciliation! This is a process that every accountant needs to know, and once you get the hang of it, it’s surprisingly satisfying. Imagine your financial records aligning perfectly with what the bank shows—that’s the goal of reconciliation. It’s more than just a check-and-balance; it’s a way to ensure that every penny in your records reflects real-world transactions.

In this guide, we’ll walk you through the bank reconciliation process in simple steps. We’ll dive into the reasons why reconciliation matters, explain the mirror-image relationship between your ledger and the bank statement, and guide you through each step until your bank ledger matches the bank’s record. By the end, you’ll understand how to turn any adjustments into journal entries, which keeps your records up to date. Let’s get started!

Understanding Your Financial Records

Before we dive into reconciliation, let’s introduce the main players: your bank ledger and the bank statement. These two records are like a conversation between your business and the bank.

- Bank Ledger: This is your record, tracking every transaction. It includes details on payments made, money received, checks issued, and any other cash flow. It’s updated every time a transaction occurs. Think of it as your “internal” view of your cash activity.

- Bank Statement: This is the official record from the bank’s side, detailing every transaction processed during a given period. The statement comes directly from the bank, showing how they see your account activity.

Why You Need Both

Your bank ledger shows your view of transactions as they happen, while the bank statement shows the bank’s view, which sometimes differs due to processing times or missed entries. Reconciliation lets you make sure both views match up, creating a complete picture of your cash flow.

The Bank Statement as a Mirror Image of the Bank Ledger

Now, here’s a cool concept that often surprises students: the bank statement is a mirror image of your bank ledger. This happens because of the way the bank sees your account.

Think of it like this:

- When you add money to your bank account, it’s an asset for you, but for the bank, it’s actually a liability. Why? Because the bank technically owes you that money!

- So, debits and credits on your bank statement are the reverse of what they appear in your ledger.

Let’s Break This Down:

In your bank ledger:

- Debits increase your cash account (like when you receive payments).

- Credits decrease your cash account (like when you pay a supplier).

In the bank statement:

- Credits represent deposits (money you put in), so they increase your balance from the bank’s perspective.

- Debits represent withdrawals, reducing the bank’s liability to you (since they owe you less money after you withdraw it).

This mirror-image effect can feel a bit confusing at first, but just remember that it’s all about perspective. To you, deposits are assets, but to the bank, they’re liabilities.

Why Do Discrepancies Happen?

Discrepancies in bank reconciliation are completely normal. Here’s why:

- Timing Differences: Some transactions don’t clear the bank right away. For instance, a check issued on January 1 might not clear until January 5. This creates a delay between your record and the bank’s.

- Recording Errors: Mistakes happen! A number might get entered incorrectly, or a transaction might be duplicated. These little errors can add up and throw off your reconciliation.

- Unrecorded Items: Sometimes, there are items only the bank knows about—such as fees or automatic deductions. These might show up only on the bank statement, which means you’ll need to add them to your ledger to keep things balanced.

By understanding these common causes, you’ll be better prepared to spot and fix discrepancies quickly.

Why Regular Bank Reconciliation is Important

Bank reconciliation is like a monthly checkup for your financial health. Here’s why it’s essential:

Think of it like this:

- Prevents Fraud: Regular reconciliation can reveal unauthorized or suspicious transactions. It’s a key way to catch fraud early, whether it’s an unfamiliar charge or duplicate payments.

- Accurate Cash Management: Accurate balances mean you know exactly what’s in the bank. This makes budgeting easier and prevents overdrafts or costly fees.

- Improves Financial Reporting: Your financial reports need to be accurate. Reconciliation keeps your records reliable, which is critical for auditors, investors, and stakeholders.

- Prevents Small Errors from Compounding: Even small errors can build up over time. Reconciling every month (or even more often) ensures that you’re always working with accurate numbers.

In short, reconciliation is a foundational habit that keeps your finances clear, prevents mistakes, and ultimately strengthens your financial standing.

How Technology is Changing Reconciliation

Today, accounting software like QuickBooks, Xero, and Sage make reconciliation much faster and easier. Here’s how:

- Automatic Transaction Matching: Software can often match transactions that appear in both the bank ledger and the bank statement automatically. For instance, if there’s a payment for $500 on both sides, the software flags it as a “match,” saving you time.

- Alerts for Discrepancies: When software finds items that don’t match, it alerts you to review these specific entries, so you don’t have to comb through everything line by line.

- Reconciliation Templates: Most accounting software includes templates to make creating reconciliation statements straightforward.

While software can speed up the process, it’s still helpful to understand the basics of reconciliation. Automation is great, but a human eye is best for catching subtler issues.

Practical Steps in the Bank Reconciliation Process

Ready to get hands-on? Here are the steps to reconcile your bank account:

Step 1: Gather All Relevant Documents

Collect:

- Bank Statement: The official record from the bank.

- Bank Ledger: Your own record of transactions.

- Receipts and Invoices: For verifying entries if you find something unexpected.

Step 2: Match the Opening Balances

Ensure the opening balance on the bank statement matches the opening balance on your ledger. If not, you may have an unresolved issue from a previous period.

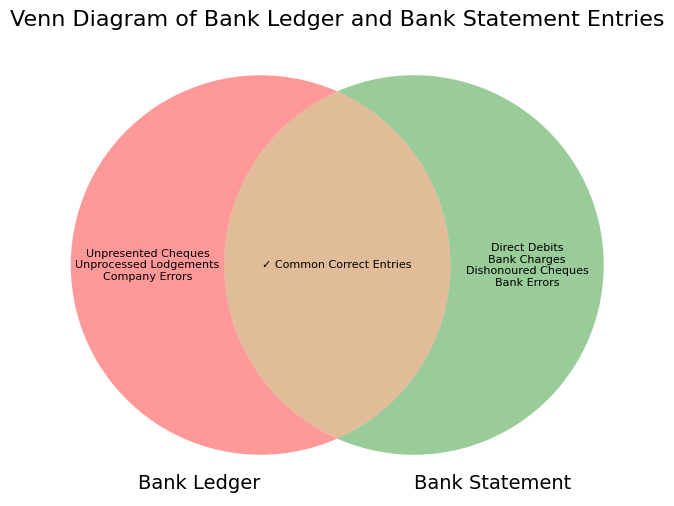

Step 3: Tick Off Matching Entries

Go through each transaction on the bank statement and check it against the ledger. Tick off the ones that match on both documents, so you’re left only with entries that need further attention.

Step 4: Identify Discrepancies

Here’s where you play detective! Check for:

- Unpresented Cheques: Checks you’ve recorded but haven’t yet cleared the bank.

- Outstanding Deposits: Deposits recorded in your ledger that aren’t on the bank statement yet.

- Bank Fees or Direct Debits: Charges or automatic payments initiated by the bank that haven’t been recorded in your ledger.

Step 5: Prepare the Bank Reconciliation Statement

Now, create a summary showing adjustments and ensuring both the ledger and the bank statement balance match. This document is your proof that everything is accounted for.

Step 6: Make Adjustments in the Bank Ledger

Add any missing items to the ledger, like bank fees, so your records match the adjusted balance that has been calculated in the reconciliation process

Turning Adjustments into Journal Entries

Once you’ve completed reconciliation, it’s time to make things official with journal entries. These entries adjust your books based on the changes you made in the reconciliation process. Here’s how it works:

- Identify Adjustments: Look at the discrepancies you found, like bank fees, interest income, or unrecorded deposits.

- Record Journal Entries: Each adjustment becomes a journal entry, making sure your ledger reflects reality. For instance, if the bank charged a $15 fee, you’d record it as an expense in your books.

- Ensure Accuracy: Double-check that each journal entry correctly reflects the type and amount of each adjustment.

Journal entries are the final step in the reconciliation process, turning temporary adjustments into permanent records. This keeps your books accurate and up-to-date.

Understanding Why Debits and Credits Flip in Reconciliation

It might feel strange that your bank’s debits are your credits, and vice versa. But remember, from the bank’s perspective, your account is a liability.

Think of it like this:

- When you add money to your account, the bank owes you more, which increases its liability (debit on your ledger, credit on theirs).

- When you withdraw, the bank’s liability decreases (credit on your ledger, debit on theirs).

This flipping of debits and credits is due to the mirror-image relationship we mentioned earlier. As you work through reconciliation, keeping this in mind can help you understand why certain items appear as debits or credits on the bank statement.

Common Mistakes in Reconciliation and How to Avoid Them

Even with experience, mistakes happen. Here are a few common ones and tips to avoid them:

- Ignoring Small Discrepancies: Small differences can add up over time, so double-check each entry.

- Incorrect Dates: Ensure dates match the actual transaction date to avoid confusion.

- Duplicate Entries: Duplicates can throw off your balance. Regularly review for accidental duplicate entries.

- Misclassifying Transactions: Labelling something incorrectly (e.g., recording a refund as revenue) can mess up your financial reports.

Pro Tip: A checklist can be a lifesaver for catching errors before they become bigger problems.

Different Formats of Bank Reconciliation

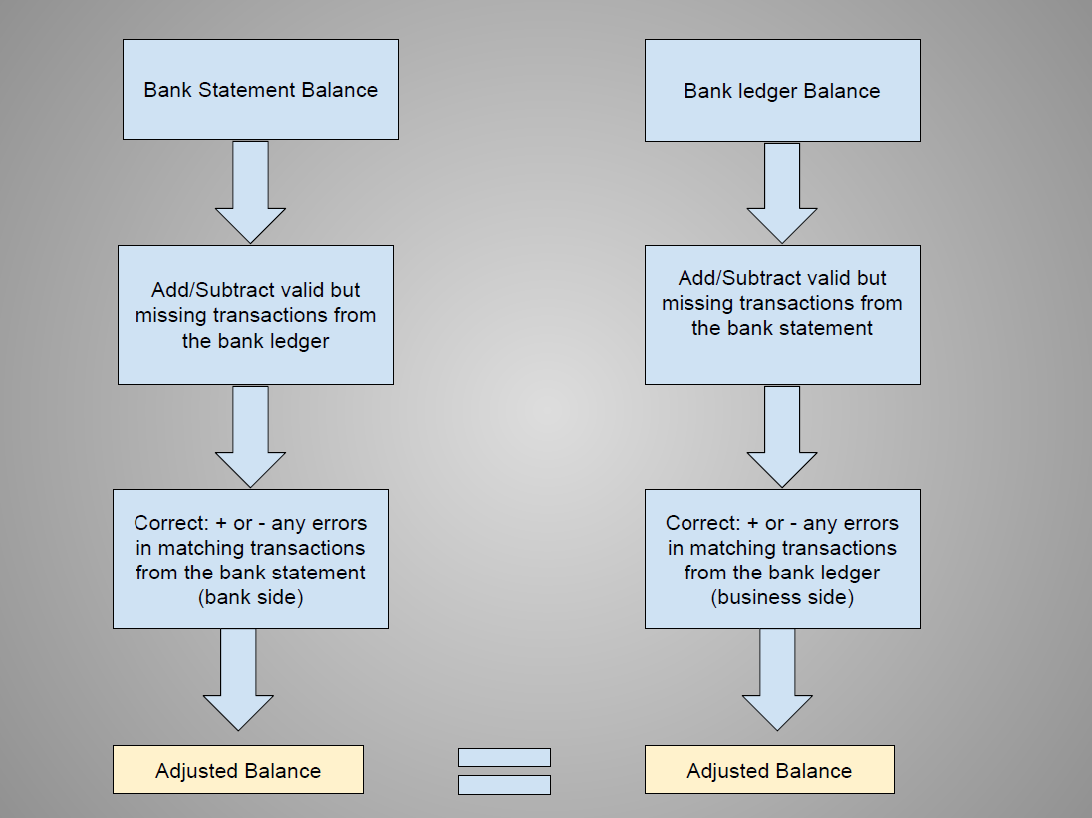

Bank reconciliation can be performed in different formats, each with a slightly different approach to aligning the bank statement balance with the bank ledger balance. Understanding these formats helps you choose the one best suited to the situation:

- Bank Statement to Bank Ledger: This method starts with the bank statement balance and adjusts it to match the bank ledger balance. Adjustments typically include outstanding cheques, deposits in transit, and other timing differences. This format is ideal when the ledger is considered accurate, and the focus is on explaining the differences in the bank statement.

- Bank Ledger to Bank Statement: In this approach, the reconciliation begins with the bank ledger balance and adjusts it to align with the bank statement. Adjustments may include recording unaccounted-for bank charges, interest income, or direct debits. This method is useful when the bank statement is the more reliable record and the ledger needs updating.

- Side-by-Side Comparison: This format involves placing the bank statement and bank ledger side by side and systematically comparing each transaction. Matching entries are ticked off, and unmatched items are investigated and adjusted as needed. While thorough, this method can be time-consuming, especially for accounts with high transaction volumes or complex discrepancies.

The goal of all these formats is to reconcile the bank statement and bank ledger to the same adjusted balance. Each format has its strengths, and the choice often depends on the type of discrepancies and the accuracy of the records being compared. By mastering these formats, you’ll be equipped to handle reconciliations in a variety of scenarios.

Example: Reconciliation in Action

To bring it all together, let’s walk through a complete example of reconciling a bank account from start to finish.

Bank Statement January 2024

| Date | Details | Debit | Credit | Balance | Balance Check Mark |

|---|---|---|---|---|---|

| 2024-01-01 | Opening balance | 10,000 Cr | ✓ | ||

| 2024-01-02 | Credit Cards 01/01/2024 | 5,395 Cr | 15,395 Cr | ✓ | |

| 2024-01-03 | Cheque 102568 | 150 Dr | 15,245 Cr | ✓ | |

| 2024-01-07 | EFT Deposit from Customer B | 1,000 Cr | 16,245 Cr | ✓ | |

| 2024-01-10 | DD Electricity Suppler | 356 Dr | 15,889 Cr | ||

| 2024-01-11 | Cheque 102569 | 253 Dr | 15,636 Cr | ✓ | |

| 2024-01-13 | Credit Cards 12/01/2024 | 6,842 Cr | 22,478 Cr | ✓ | |

| 2024-01-14 | EFT Payment to Supplier E | 1,547 Dr | 20,931 Cr | ✓ | |

| 2024-01-15 | Bank Charges | 15 Dr | 20,916 Cr | ||

| 2024-01-16 | Returned Cheque Customer A | 568 Dr | 20,348 Cr | ||

| 2024-01-17 | Credit Cards 16/01/2024 | 5,683 Cr | 26,031 Cr | ✓ | |

| 2024-01-18 | DD Telephone Supplier | 689 Dr | 25,342 Cr | ✓ | |

| 2024-01-19 | EFT Deposit from Customer A | 3,524 Cr | 28,866 Cr | ✓ | |

| 2024-01-20 | Cheque 102571 | 1,256 Dr | 27,610 Cr | ✓ | |

| 2024-01-22 | Credit Cards 21/01/2024 | 9,657 Cr | 37,267 Cr | ✓ | |

| 2024-01-23 | Lodgement | 3,524 Cr | 40,791 Cr | ✓ | |

| 2024-01-24 | Bank Interest | 3 Cr | 40,794 Cr | ||

| 2024-01-26 | Cheque 102569 | 9,654 Dr | 31,140 Cr | ✓ | |

| 2024-01-27 | Bank Loan Granted | 15,000 Cr | 46,140 Cr | ||

| 2024-01-28 | EFT Deposit from Customer C | 5,684 Cr | 51,824 Cr | ✓ | |

| 2024-01-29 | Cheque 102572 | 653 Dr | 51,171 Cr | ✓ |

Bank Ledger January 2024

| Date | Details | Debit (Dr) | Credit (Cr) | Balance | Check Mark |

|---|---|---|---|---|---|

| 2024-01-01 | Opening balance | 10,000 Dr | ✓ | ||

| 2024-01-01 | Credit Cards Sales | 5,395 Dr | 15,395 Dr | ✓ | |

| 2024-01-03 | Cheque 102568 | 150 Cr | 15,245 Dr | ✓ | |

| 2024-01-07 | EFT Deposit from Customer B | 1,000 Dr | 16,245 Dr | ✓ | |

| 2024-01-11 | Cheque 102569 | 253 Cr | 15,992 Dr | ✓ | |

| 2024-01-12 | Credit Cards Sales | 6,842 Dr | 22,834 Dr | ✓ | |

| 2024-01-14 | EFT Payment to Supplier E | 1,547 Cr | 21,287 Dr | ✓ | |

| 2024-01-15 | Cheque 102570 | 3,457 Cr | 17,830 Dr | ||

| 2024-01-16 | Credit Cards Sales | 5,683 Dr | 23,513 Dr | ✓ | |

| 2024-01-18 | DD Telephone Supplier | 689 Cr | 22,824 Dr | ✓ | |

| 2024-01-19 | EFT Deposit from Customer A | 3,524 Dr | 26,348 Dr | ✓ | |

| 2024-01-20 | Cheque 102571 | 1,256 Cr | 25,092 Dr | ✓ | |

| 2024-01-21 | Credit Cards Sales | 9,657 Dr | 34,749 Dr | ✓ | |

| 2024-01-23 | Lodgement | 3,524 Dr | 38,273 Dr | ✓ | |

| 2024-01-26 | Cheque 102569 | 9,654 Cr | 28,619 Dr | ✓ | |

| 2024-01-28 | EFT Deposit from Customer C | 5,684 Dr | 34,303 Dr | ✓ | |

| 2024-01-29 | Cheque 102572 | 653 Cr | 33,650 Dr | ✓ | |

| 2024-01-30 | Credit Cards Sales | 6,957 Dr | 40,607 Dr |

Reconciling Step-by-Step

- Match Entries: Check off matching transactions on both sides.

- Identify Missing Items: In our examples case Direct Debits, Bank charges, missing credit card lodgements etc (listed in the reconciliation)

- Prepare Reconciliation Statement: Generate the reconciliation with the missing entries.

- Make Journal adjustments to bank ledger to match adjusted balance: Go through the procedure of double entry to include any missing entries on the ledger side.

Bank Statement to Bank Ledger Format

| Bank Reconciliation | EUR |

|---|---|

| Bank Statement Balance | 51,171 |

| Cheque 102570 | -3,457 |

| Credit Cards Sales (Not lodged until the next day) | 6,957 |

| Adjusted Balance | 54,671 |

| DD Electricity Suppler | 356 |

| Bank Charges | 15 |

| Returned Cheque Customer A | 568 |

| Bank Interest | -3 |

| Bank Loan Granted | -15,000 |

| Bank ledger balance | 40,607 |

Bank Ledger to Bank Statement Format

| Bank Reconciliation | EUR |

|---|---|

| Bank ledger balance | 40,607 |

| DD Electricity Suppler | -356 |

| Bank Charges | -15 |

| Returned Cheque Customer A | -568 |

| Bank Interest | 3 |

| Bank Loan Granted | 15,000 |

| Adjusted Balance | 54,671 |

| Cheque 102570 | 3,457 |

| Credit Cards Sales (Not lodged until the next day) | -6,957 |

| Bank Statement Balance | 51,171 |

Side By Side Format

Bank Reconciliation as at 2024-01-31

| Bank Statement Balance | 51,171 | Bank ledger balance | 40,607 | ||

| Cheque 102570 | -3,457 | DD Electricity Suppler | -356 | ||

| Credit Cards Sales (Not lodged until the next day) | 6,957 | Bank Charges | -15 | ||

| Returned Cheque Customer A | -568 | ||||

| Bank Interest | 3 | ||||

| Bank Loan Granted | 15,000 | ||||

| Adjusted Balance | 54,671 | Adjusted Balance | 54,671 |

Recording Bank Ledger Adjustments as Journal Entries

The discrepancies identified need to be entered into the company’s journal to update the bank ledger. Below are the entries corresponding to each adjustment:

- Direct Debit for Electricity Supplier

- Recorded on 10/01/2024, this EUR 356 debit appears only on the bank statement.

| Date | Account | JN | Debit | Credit |

|---|---|---|---|---|

| 2024-01-10 | Electricity Expense | 1254 | 356 | |

| 2024-01-10 | Bank Account | 1254 | 356 |

Explanation: The entry records an increase in expense and a decrease in the bank balance.

- Bank Charges On 15/01/2024, £15 in bank charges appear on the bank statement but not in the bank ledger.

| Date | Account | JN | Debit | Credit |

|---|---|---|---|---|

| 2024-01-15 | Bank Charges Expense | 1255 | 15 | |

| 2024-01-15 | Bank Account | 1255 | 15 |

Explanation: This entry records the bank charges as an expense and reduces the bank balance

- Returned Cheque (Customer A) A cheque for £568 from Customer A was returned on 16/01/2024.

| Date | Account | JN | Debit | Credit |

|---|---|---|---|---|

| 2024-01-16 | Accounts Receivable | 1256 | 568 | |

| 2024-01-16 | Bank Account | 1256 | 568 |

Explanation: The company reinstates the receivable from Customer A while reflecting the cash outflow.

- Bank Interest Earned Interest earned (£3) appears on 24/01/2024 in the bank statement only.

| Date | Account | JN | Debit | Credit |

|---|---|---|---|---|

| 2024-01-24 | Bank Account | 1257 | 3 | |

| 2024-01-24 | Interest Income | 1257 | 3 |

Explanation: This entry records interest as income, increasing the cash balance.

- Bank Loan Granted On 27/01/2024, the bank statement records a loan deposit of £15,000.

| Date | Account | JN | Debit | Credit |

|---|---|---|---|---|

| 2024-01-27 | Bank Account | 1258 | 15,000 | |

| 2024-01-27 | Loan Payable | 1258 | 15,000 |

Explanation: This entry reflects the cash inflow from the loan and records a liability.

Final Thoughts: Why Reconciliation is Worth Mastering

Bank reconciliation is a critical skill that brings order to your records, helps prevent errors, and safeguards against fraud. By making it a regular habit, you’ll be more confident in your financial reporting, cash management, and decision-making. Plus, it’s a skill that’s valuable in every industry.

Happy reconciling! With this guide and a little practice, you’ll be a pro in no time.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

About Us

Legal

Copyright ©2024 Accounting Training. All Rights Reserved

Course Outline

- Concepts and Accounting

- The Three Different Natures of Accounts

- The Accounting Equation

- Accrual Accounting

- Debits and Credits

- The Journal

- Bank Reconciliation

- Adjusting Entries

- Inventory and Cost of Sales

- Depreciation

- Income Statement

- Chart of Accounts

- Accounting Principles

- Financial Accounting

- Financial Statements

- Balance Sheet

- Working Capital and Liquidity

- Cash Flow Statement

- Financial Ratios

- Accounts Receivable and Bad Debts Expense

- Accounts Payable

- Inventory and Cost of Goods Sold

- Payroll Accounting

- Bonds Payable

- Stockholders’ Equity

- Present Value of a Single Amount

- Present Value of an Ordinary Annuity

- Future Value of a Single Amount

- Nonprofit Accounting

- Break-even Point

- Improving Profits

- Evaluating Business Investments

- Manufacturing Overhead

- Nonmanufacturing Overhead

- Activity Based Costing

- Standard Costing